There are no lenient rules or generous breaks for nonprofits, especially small nonprofits, to provide decent affordable health insurance for their employees. So we’re often faced with high premiums or poor benefit options.

In January 2019, the U.S. Department of Labor’s final rule regulating association health plans (AHPs) went into effect. In an effort to increase access to AHPs, small businesses (including nonprofits) can join together to create one big association to provide health insurance for its members. The rule:

- Allows associations to form for the primary purpose of offering health insurance;

- Revises the “commonality of interest standard” so that associations can include members based on a common business purpose or location within the same city or state; and

- Allows self-employed individuals or one-person staffs to participate in an association.

There are pros and cons to the arrangements that health care advocates are hashing out, namely that healthy individuals will move to AHPs causing imbalances in state and small insurance markets that could lead to significant cost increases and limited benefits. This has spurred states to consider and implement their own regulations within the context of the DOL’s rule.

The NC Department of Insurance is not currently approving association plans. But the NC House and NC Senate are considering a variety of approaches to allow new association health plans to be created in North Carolina.

The Center is following the issue closely to advocate on behalf of nonprofits’ best interests if and when the need arises.

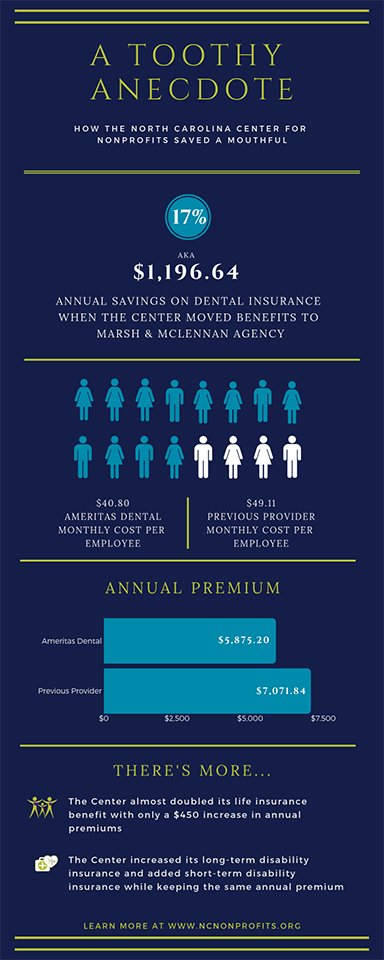

In the meantime, the Center has partnered with two reputable brokerages to offer options for affordable quality insurance benefits for nonprofits and their employees (check out the Center’s real-life experience).

In the meantime, the Center has partnered with two reputable brokerages to offer options for affordable quality insurance benefits for nonprofits and their employees (check out the Center’s real-life experience).

Marsh & McLennan Agency

Marsh & McLennan Agency (MMA) is an insurance brokerage and consultancy that offers several employee benefits for nonprofits of all sizes, including:

Dental and Vision Insurance. Three competitive plan designs will offer exclusive rates* and guaranteed savings for nonprofits transitioning from existing plans.

Life & Disability Insurance. Both basic and voluntary plans will offer significant cost savings for nonprofits,* including those with existing plans in place.

Accident, Critical Illness & Whole Live Coverage. These plans offer better pricing* and enhanced provisions otherwise available to most nonprofits.

Participants also have access to a benefit technology platform to help simplify the benefits administration process for you and your employees. Learn more and contact MMA if you are interested in taking advantage of these employee benefits options.

*MMA offers benefits services to nonprofits that might not otherwise be available; Center Members, specifically, see significant savings (that often offset the cost of membership). Join now to save more.

Nonstop Wellness

Nonstop Wellness offers larger nonprofits (50+ employees on their health insurance plan) a partially self-insured health insurance program that reduces premium costs and eliminates all out-of-pocket expenses for employees. This means nonprofit employees on the Nonstop Wellness program have a $0 co-pay, $0 deductible, and $0 coinsurance plan – all achieved with no cost shifting, carrier changes, or financial liability for the nonprofit. For more information, contact info@nonstopwellness.com.

Sources and Resources

The New Association Health Plan Rule: What Are the Issues and Options for States, National Academy for State Health Policy

Legislature Makes another Attempt at Creating Association Health Plans, North Carolina Health News

Taking the Pulse of New Association Health Plans, C&M Health Law

Association Health Plans Put Patients, Workers, and Insurance Markets At Risk, North Carolina Justice Center

Health Care Reform, National Council of Nonprofits

Frequently Asked Questions by Nonprofits About the Affordable Care Act, National Council of Nonprofits

Knowing Your Options, Nonstop Wellness

Six Questions to Ask Healthcare Brokers During Renewal Season, Nonstop Wellness

2019: What to Expect in Employee Health & Benefits, Marsh & McLennan Agency