There are no lenient rules or generous breaks for nonprofits, especially small nonprofits, to provide decent affordable health insurance for their employees. So we’re often faced with high premiums or poor benefit options.

To offer the best possible options for North Carolina nonprofits, the Center partners with two reputable brokerages to offer options for affordable quality insurance benefits for nonprofits and their employees (check out the Center’s experience→).

To offer the best possible options for North Carolina nonprofits, the Center partners with two reputable brokerages to offer options for affordable quality insurance benefits for nonprofits and their employees (check out the Center’s experience→).

And we continue to work on the various options that nonprofits – particularly small organizations – have for ensuring that their employees have access to the best possible health coverage.

Association Health Plan

The North Carolina Center for Nonprofits is partnering with Marsh McLennan Agency and Blue Cross Blue Shield of NC to offer an Association Health Plan for Center Members. We understand that many nonprofits experience challenges in providing and navigating health insurance benefits for their employees, and we want to help!

What Is an Association Health Plan?

An Association Health Plan (AHP) or Multiple Employer Welfare Arrangement (MEWA) is a means of providing a welfare benefit, including medical, dental, vision, and ancillary coverages to employers with two or more employees who are part of a bona fide association. AHPs allow for a group of employers to bring purchasing power to the benefits negotiation process as well as the opportunity to benefit from a larger pool of employees resulting in more stability for smaller employers.

The AHP will not be a solution for all nonprofits but offers an additional option for organizations to evaluate in their own benefit analysis. The goal is to provide a variety of plan options that will offer some organizations more competitive pricing than what is available in the marketplace today.

To learn more about the Center's Association Health Plan for Members, watch the recording from our information session.

Other Options for Center Members

Marsh McLennan Agency

Marsh McLennan Agency (MMA) is an insurance brokerage and consultancy that offers several employee benefits for nonprofits of all sizes, including:

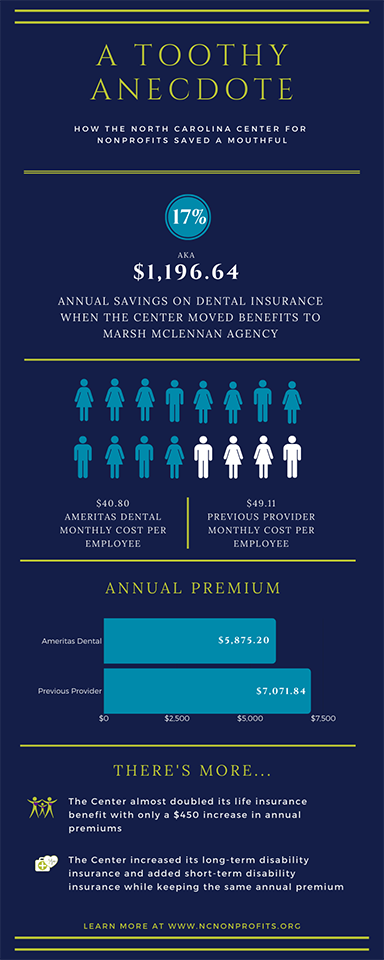

- Dental and Vision Insurance. Three competitive plan designs will offer exclusive rates* and guaranteed savings for nonprofits transitioning from existing plans.

- Life & Disability Insurance. Both basic and voluntary plans will offer significant cost savings for nonprofits,* including those with existing plans in place.

- Accident, Critical Illness & Whole Live Coverage. These plans offer better pricing* and enhanced provisions otherwise available to most nonprofits.

- Employee Assistance Program (EAP). Resources and counseling for employees and their families to help support their work, health, mental, and emotional well-being.

Participants also have access to a benefit technology platform to help simplify the benefits administration process for you and your employees. Learn more about MMA's services, how they address nonprofits' top concerns, and contact MMA if you are interested in taking advantage of these employee benefits options.

*MMA offers benefits services to nonprofits that might not otherwise be available; Center Members, specifically, see significant savings (that often offset the cost of membership). Join now to save more.

Nonstop

Nonstop Administration and Insurance Services, Inc. was founded in 2012 with a vision to reduce barriers in access to healthcare. Designed for organizations with more than 50 employees on benefits, its core product, Nonstop Health, uses an innovative first-dollar approach to plan design that provides cost certainty and savings for employers, and reduces premiums while reducing or eliminating upfront expenses for employees and their families. Nonstop also understands that your broker is often a trusted advisor and key part of your health benefits purchasing team and can partner with your trusted broker to deliver the Nonstop Health program. Learn more or contact Lesley Brown Albright, 503-309-4586.

Other Options for Nonprofits

There isn't a one-size-fits-all health insurance solution for all nonprofits. Here are some other options that your nonprofit may want to consider:

Affordable Care Act Requirements for Large Nonprofits (50+ full-time employees)

Nonprofits with 50 or more full-time employees are generally required to provide health benefits for their employees under the Affordable Care Act (ACA). For more on the ACA large employer mandate, check out the Internal Revenue Service resources on employer shared responsibility provisions.

Exclusive Provider Organization (EPO) Plans

Under a law that took effect on October 1, 2021, North Carolina nonprofits and small businesses can form exclusive provider benefit (EPO) plans for their employees. EPO plans are about 10% less expensive than other health insurance plans and allow participants to use a limited network of local health care providers while paying the full cost for any out-of-network health services other than emergency care. Right now, EPO plans are available to nonprofits in some urban parts of the state where large healthcare networks offer a wide range of in-network provider options. To learn more about whether an EPO plan might be a good fit for your nonprofit, contact your broker (see above for contact information for MMA).

Affordable Care Act Small Business Health Care Tax Credit

Some nonprofits that offer group health plans may be eligible for a refundable tax credit to help offset the costs of offering employer-provided health coverage. The Small Business Health Options Program (SHOP) may be an option for nonprofits with fewer than 25 full-time employees if their average salary is $56,000 or less, they pay at least half of their employees health insurance premium costs, and they make their health plans available to all full-time employees. The dollar amount of the credit is larger for nonprofits with fewer employees and lower average salaries. For more, check out the SHOP resources at HealthCare.gov.

Qualified Small Employer Health Reimbursement Arrangement (QSEHRA)

Nonprofits with fewer than 50 employees that don't offer group health plans or flexible spending accounts (FSAs) have the option of forming QSEHRAs. Under these arrangements, nonprofits offer their employees non-taxed reimbursement for health insurance premiums, co-insurance, and certain other health-related expenses. Nonprofits that offer QSEHRAs generally need to offer the same terms to all full-time employees. QSEHRAs may offer more health care options for some nonprofit employees, but they also require employees to find their own health coverage through the ACA Marketplace and submit montly reimbursement claims for their health care premiums and other expenses. For more, check out the QSEHRA resources at HealthCare.gov.

Professional Employer Organizations (PEOs)

Some nonprofits opt for "co-employment" arrangements through a Professional Employer Organization (PEO). Nonprofits that use PEOs maintain control over hiring and firing their employees and setting most of their personnel policies. However, much of their administration – like their payroll processing – and their employee benefits are offered through the PEO, which can typically offer more affordable and higher quality options by pooling together a large group of employees from many different organization. Nonprofits that become part of PEOs give up their existing employee benefits so this isn't the best option for every organization. For more, check out the National Council of Nonprofits' explanation of how PEOs can work for small nonprofits.

Sources and Resources

New law aims at cutting health insurance costs. How much can it really help?, NC Health News

Lower-Cost Insurance Offering for NC Business Gets OK, Associated Press

North Carolina Health Insurance Marketplace: History and News of the State’s Exchange, HealthInsurance.org

Is Small Business Health Care Act the Best Option?, North Carolina Business Council

The New Association Health Plan Rule: What Are the Issues and Options for States, National Academy for State Health Policy

Legislature Makes another Attempt at Creating Association Health Plans, North Carolina Health News

Taking the Pulse of New Association Health Plans, C&M Health Law

Association Health Plans Put Patients, Workers, and Insurance Markets At Risk, North Carolina Justice Center

Knowing Your Options, Nonstop Wellness

Six Questions to Ask Healthcare Brokers During Renewal Season, Nonstop Wellness