The Center has partnered with Marsh McLennan, Blue Cross Blue Shield of North Carolina, and Vimly Benefit Solutions to offer health care coverage for its 501(c)(3) members. This Association Health Plan will help nonprofits navigate the challenges they experience in providing health insurance benefits to their employees.

Watch the most recent Association Health Plan Information Session

Slides from the latest Information Session Presentation

What Is an Association Health Plan?

An Association Health Plan (AHP) or Multiple Employer Welfare Arrangement (MEWA) is a means of providing a welfare benefit, including medical, dental, vision, and other coverages to employers with two or more employees who are part of a bona fide association. AHPs allow a group of employers to bring purchasing power to the benefits negotiation process as well as the opportunity to benefit from a larger pool of employees resulting in more stability for smaller employers.

The AHP will not be a solution for all nonprofits but offers an additional option for organizations to evaluate in their own benefit analysis. The goal is to provide a variety of plan options that will offer some organizations more competitive pricing than what is available in the marketplace today.

What Coverages does the AHP Offer?

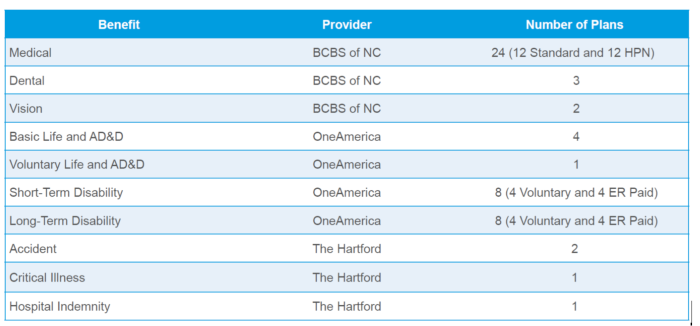

The plan offers 24 different BCBS medical insurance options, plus dental, vision, life, short- and long-term disability, accident, critical illness, and hospital indemnity benefits. Medical plan offerings include high-deductible health plans, copay and coinsurance plans, and all-copay plans, with pricing based on 20 risk tiers. Nonprofit employers can offer multiple plan options to employees for tailored coverage.

Why Join the AHP?

Joining together with other Center members can:

- Lower pricing by pooling members and risk

- Help stabilize costs and lower risk through a fully insured plan which allows for premiums based on employee experience and provides long-term rate stability and more predictable renewals

- Allow for better benefit options that may not currently be available to you or your employees

- Provide access to powerful and intuitive technology which can be used for eligibility, enrollment, education, and member support

Who’s eligible and what are the requirements of participation?

Any 501(c)(3) nonprofit organization that is a current member of the Center is eligible to participate. Nonprofits don’t have to be a member to receive a health insurance proposal but must join the Center before enrolling in the plan. Active membership must be maintained in order to remain eligible.

Learn more about the cost and benefits of Center membership.

Participation Requirements:

- 50% of the full-time employee population must be enrolled in the medical offering, with a minimum of 2 employees

- Employees must elect medical coverage in order to elect other benefits

- Participation requirements for all other benefits is a minimum of 2 employees

Employer Contribution Requirements:

- Medical: Employers must cover 50% of the employee only monthly premium

- Dental & Vision: Employers must cover 25% of the employee only monthly premium

- Other Benefits: No contribution requirements

How do I Receive an Insurance Quote?

- Complete the Interest Form.

- Submit the census**

- BCBS determines your group’s risk band and creates a proposal

- This process usually takes 5-7 business days.

**Census and demographic information:

- Employers must submit census and demographic information for their employees and any covered dependents in order to receive a proposal.

- BCBS of NC uses age, gender, location, and industry to quote your group and assign a risk band.

- Plan pricing is based on the assigned risk band of each organization. There are 20 risk bands organizations can be assigned to. Generally, the lower the risk band, the lower the pricing.

What are others saying?

Who’s Involved?

NCCNP: Serves as the plan sponsor

Marsh McLennan Agency: Serves as the insurance broker to the Trust, carrier liaison all insurance providers, group enrollment support to participating organizations.

Blue Cross Blue Shield of NC: Serves as the insurance provider offering medical, dental, and vision benefits.

OneAmerica: Serves as the insurance provider offering basic and voluntary life insurance, accidental death and dismemberment coverage, as well as short and long-term disability insurance.

The Hartford: Serves as the insurance provider offering accident, critical illness, and hospital indemnity coverages.

Vimly: Serves as the Association Health Plan Technology Vendor who offers broker support, employer support (questions, billing, enrollment), COBRA support (notices, elections, invoicing, collection), 1095-C reporting, and carrier integration.

SIMON is Vimly's benefits platform utilized by employers and employees. It provides for open enrollment, member maintenance (adding, terminating and changing employees and dependents), dependent eligibility verification, reporting, and hosts a resource library with videos and instruction guides to assist groups with employee management.

Meet the Team

Interested in Learning More or Participating?

Join the free information session on March 7, 2025 from 11 am-12 pm to learn more about the AHP plan and ask questions: [INSERT UPCOMING INFORMATION SESSION REGISTRATIO LINK- When is the next session? I couldn't find any upcoming events?]

If your organization is interested in participating in in the AHP, complete this contact form.

We’re excited to finally be able to offer this Member benefit and to help ensure nonprofit careers are sustainable. We look forward to continuing to support you and the impactful work you do in communities around the state.

Learn more about the cost and benefits of Center membership.