A nonprofit board member is essential in an organization's investment governance. Ensuring your organization has adequate financial resources is a critical component of your responsibility, and it can be directly tied to the oversight and success of your investment program.

Here are four areas board members should focus on to ensure they manage an organization’s investment program prudently and cost-effectively.

What precisely is your role in overseeing the investment program?

1. Define Oversight Structure

Ensure the organization has the proper structure to oversee the investment program.

For many boards, this means establishing an oversight group (typically a finance or investment committee) of qualified individuals. As a board member, you want to spend time recruiting financially savvy members with the background to oversee the investment program most effectively.

2. Hire Advisors

Your board or oversight group should not select individual investments but instead recommend the selection of an investment advisor or consultant to the board.

Selecting an advisor who will act in a co-fiduciary manner ensures that the organization’s best interest will be put first. The selection should be carefully undertaken and may involve issuing a Request for Proposal to several qualified advisors.

3. Review Performance

Your oversight committee should review performance regularly and monitor compliance with the investment program’s policies.

Ideally, a summary report is shared with the board quarterly, and a presentation from the oversight group and advisor is made to the full board semi-annually or annually.

4. Keep Adequate Records

All nonprofit organizations experience turnover of board and committee members. Your board should have all policies in writing and appropriately archived. This helps newly recruited members understand the governance structure and policies that are in place. Additionally, maintaining good records of past investment decisions, performance, and portfolio structure allows board members to feel confident the program has been properly managed. These critical documents should not be stored on an individual computer or file cabinet but on a cloud-based document management system.

Understand Your Organization’s Roles and Those of Your Investment Advisor

Understanding how your organization works with investment professionals helps ensure everyone is on the same page, and your oversight requirements are met.

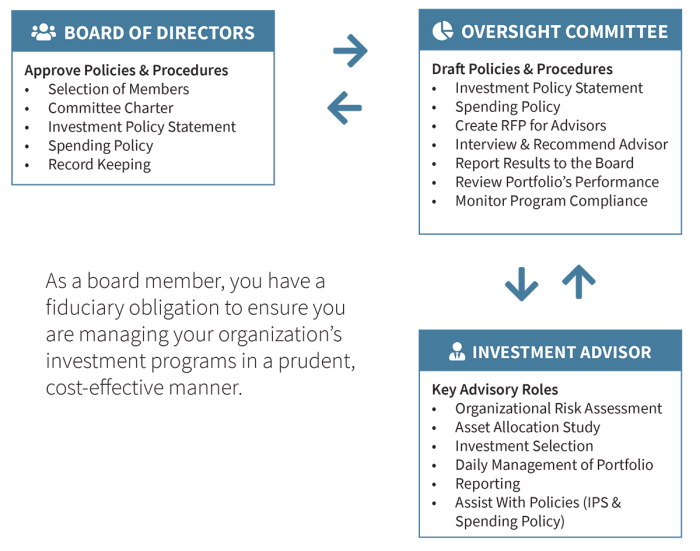

The Board of Directors typically approves policies and procedures and selects committee members. The Oversight Committee drafts these policies and supervises the investment program. The investment advisor manages the investment portfolio and ensures regular reports and updates are provided to keep all parties informed.

eCIO is a fiduciary investment advisor serving exclusively nonprofits in North Carolina and nationwide, focused on helping organizations steward reserves and long-term assets in support of their mission.

Disclosure: eCIO, Inc is a registered investment adviser with the Securities and Exchange Commission, located in Madison, Wisconsin. eCIO may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. This brochure is provided for guidance and information purposes only. Investments involve risk and are not guaranteed. Information presented is for educational purposes only intended for a broad audience. The information does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. eCIO has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. eCIO has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Please refer to the adviser’s ADV Part 2A for material risks disclosures.